As evidence builds around climate change, companies are recognizing the opportunity (and necessity) of carbon neutrality. Implementation requires an organization’s blueprint to encompass the breadth of their operation. This can seem like a tall order.

Creating an economy that functions on low-to-zero carbon energy sources is a crucial part of this process. The development and use of technology that reduces emissions is essential. Companies on this path are not just helping the environment; they are adding to their own resilience, contributing to innovative technology, and inspiring others to follow along.

Assessing Your Carbon Neutral Potential

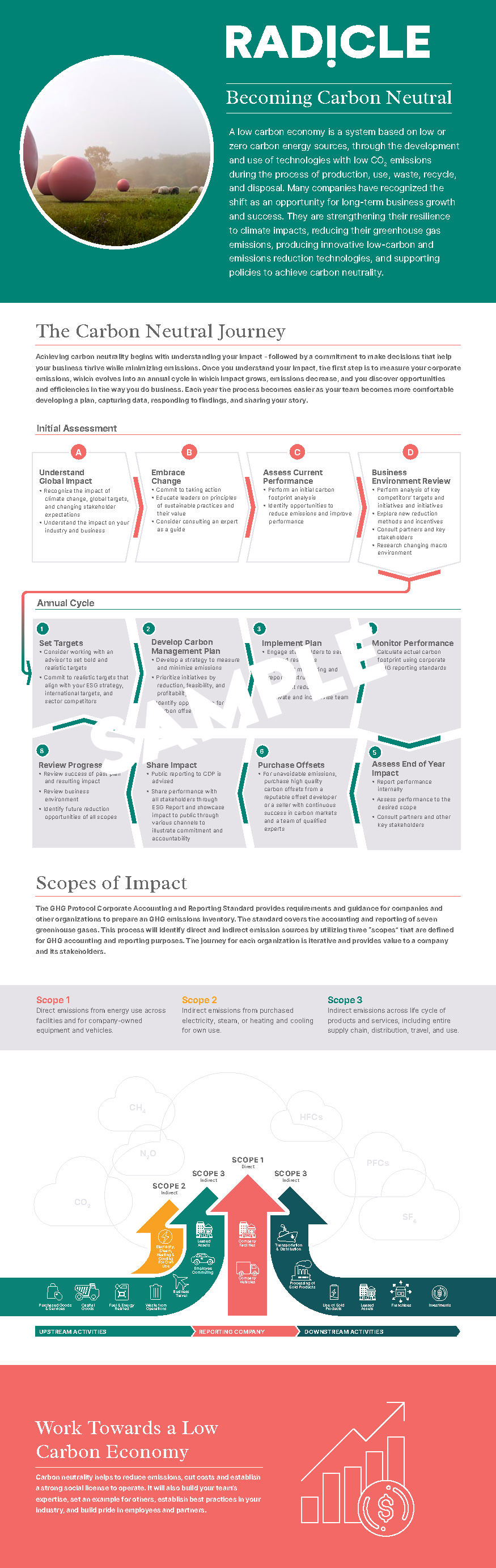

The first step toward achieving carbon neutrality is to understand your organization’s carbon impact – it’s not always fun asking “how bad is it?”, but everyone has to start somewhere. This foundation is necessary to establish an annual cycle of actionable items, improving positive impact each year while emissions fall. Rome wasn’t built in a day, nor can carbon emissions hit net-zero instantly.

Knowing Your Global Impact

Let’s place this in a global context: you may think you’re just a drop in the bucket, but when you break it down, that’s all the bucket is: a lot of drops. Campy, but true. When we grasp the effects of climate change, we begin to realize how it affects our industries; and your business today.

Embrace Change

Once we have context, we work on application: Commit to taking action, educate your organization’s leaders on the principles of sustainability, and consider hiring an expert consultant if necessary (we know a few).

Assess Your Current Performance

To create effective goals, we need accurate data. Perform an initial carbon footprint analysis, then locate opportunities for emissions reduction, increased performance, and higher efficiency.

Review Your Business Environment

To get a sense of how far your goals should go, look at your competitors and see what their targets and initiatives are. Explore new technologies, methods, and incentives; check in with partners and stakeholders. See where you can improve.

The Annual Cycle for Carbon Neutrality

Once you understand your organization’s impact and how you fit into the wider global picture, it’s time to build that annual cycle – it doesn’t have to be daunting: it is a yearly plan where you lay out goals, identify tactics, set metrics, and guide your team forward toward carbon neutrality. It doesn’t resolve in a day – it grows over 365 days.

Initial steps are meant to be bold, realistic targets that align with your ESG strategy. Competitor and international considerations also play a role. Next, develop an action plan that prioritizes initiatives along metrics: think “high school essay rubric”, only instead of spelling/grammar and topic development, swap in reduction impact, feasibility, and profitability.

Next, engage stakeholders to secure any necessary resources, and apply the plan’s tertiary elements, such as monitoring or reporting structures, or incentivization. As the year goes on, the impact of this implementation is tracked, with real carbon footprint data collection via the chosen methodologies.

At the end of the year, assess and consult key stakeholders. Determine whether you met, exceeded, or fell short of your goals. If your net emissions were higher than expected, now is the time to purchase carbon offsets from verified developers or sellers, whose projects have a correlating reduction in CO2e emissions. This should be done through a trusted market participant with a strong track record (such as Radicle – just saying).

Finally, transparency is key: share your yearly performance with stakeholders, the CDP, and the public. Your commitment to improvement matters. A progress review shows you care; focus on successes, areas of improvement, and areas that need improvement equally.

Carbon Neutrality Scopes of Impact

According to the GHG Protocol Corporate Accounting and Reporting Standard, true carbon neutrality must account for three different scopes of impact in operations:

- Direct emissions from energy use, such as in facilities and in company-owned equipment and vehicles.

- Indirect emissions from energy, such as electricity, steam, or heating/cooling (i.e., the emissions are produced elsewhere).

- Indirect emissions across the product and service life cycle, including the supply chain, distribution, travel, and consumer use.

Accounting for all emissions sources is critical in making complete annual cycles, carbon footprint analysis, action plans, and end-of-year assessments.

Business Benefits of a Low Carbon Economy

The benefits of a low carbon economy stretch beyond environmental impact. On the business side, a low carbon economy encourages innovation, which may lead to cost-saving efficiencies. This also helps build social goodwill, establishes your organization as a proactive industry leader, and can create a sense of pride for your staff. Companies that delay implementation of low carbon strategies are avoiding their own growth and opportunity; companies that present a forward-facing low carbons strategy are viewed as favourable in the court of public opinion. Responsibility matters! Lastly, some initiatives can present an opportunity for a new revenue stream through carbon credit generation.

The carbon trading market and the pathway to net-zero can seem daunting and complex for those unfamiliar with how it works. That’s what we’re here for: taking the plunge to net-zero can be very worth your while for a multitude of reasons – so reach out and let’s talk about it at info@radiclebalance.com when you’re ready to get started.

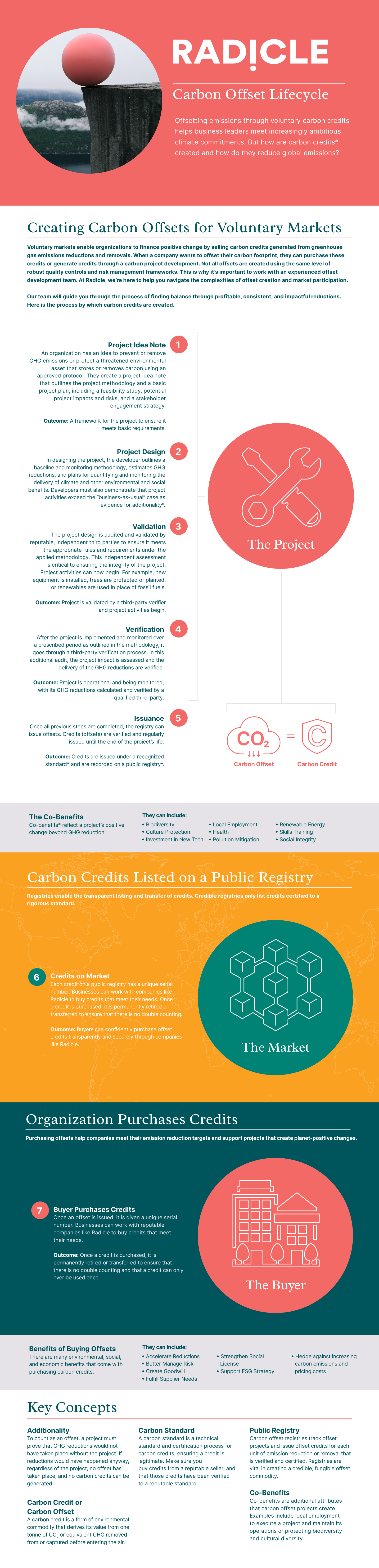

Creating Carbon Offsets for Voluntary Markets

Carbon trading and offsets are part of a sustainable and responsible future. They can serve as dependable investments for your business operations, and they offer a host of societal and environmental benefits – including reducing greenhouse gases (GHGs) and carbon dioxide equivalents (CO2e). But how are all of those offsets created?

The Life Cycle of Carbon Offsets

Carbon credits are created and sold within the voluntary trading market, allowing organizations to finance positive change via projects that reduce carbon emissions. Here’s how it works:

The Project Idea Note – “I have an idea”

It all starts when an organization creates a “project idea note.” The idea note is a concept design that aims to prevent emissions, remove emissions, or otherwise protect an environmental asset that can store or remove carbon. The project idea note covers the project’s methodology, feasibility, impact and risk assessment, and potential stakeholder engagement. If this framework meets basic requirements for a carbon offset project, it proceeds to the next step.

Designing the Project – “Here’s what my idea looks like”

In the Design phase, the project developer outlines greenhouse gas (GHG) emission parameters. In other words, they start by setting the bar for baseline emissions. Then, they figure out the best way to “temperature check” GHG emissions as the project rolls along. Since this is still a concept, they must next estimate the quantity and reduction of those emissions and then describe how to quantify and monitor the project’s value – environmental or otherwise. It is critical to prove “additionality” – that’s the necessary piece. Additionality unequivocally states that the project is responsible for GHG reductions that would not have taken place without the project.

Validating the Project Design – “Let’s check that idea.”

Next, the project developer shows their work. To validate a design, an independent third-party audits and reviews the plans. The inspection ensures accurate adherence to the methodology. Suppose the third-party offers a seal of approval. In that case, the project’s integrity is confirmed, and, pending other approvals (geographic regulation, for instance), project activities can begin – like tree planting or clean fuel replacements. The third-party auditor is also tasked with helping prove additionality, as mentioned above.

Verification of the Project – “Is this working?”

Once the project has been implemented and monitored, another independent third-party verification takes place. Isn’t it nice, all these agencies working so well together? The project results are assessed, and the overall GHG mitigation is checked. Ideally, the results align with the initial plan so that the carbon credit process can continue.

Issuing Carbon Credits – “Let’s create some value from that idea”

If the GHG results are accurate, the project is now able to provide offsets for the registry. These carbon credits (one tonne of CO2e per credit) are verified and can be regularly issued under a recognized standard until the project reaches the end of its life. The credits are then recorded in a public registry. It’s there to keep score.

Listing and Purchase of Carbon Credits

Public carbon trading registries are hubs that enable the transfer, ownership, and usage of carbon credits. Registries ensure proper credentials and the accurate tracking of offsets via unique serial numbers that identify specific credits individually.

Once a company, NGO, or other entity purchases that credit, it is transferred to the buyer’s account. This process prevents double purchases and maintains consumer confidence. Once the credit is purchased, it is permanently retired, and the associated serial number cannot be used again. This process ensures a credit cannot be claimed and then re-sold. It’s the offset version of “no takesies backsies.”

Additional Benefits of Carbon Offsets and Projects

Beyond the carbon benefits, offsets and projects have other “co-benefits” to local and regional communities. These range from investments in biodiversity, pollution reduction, and cultural heritage support to more tangible effects, including new technological innovations, higher employment rates, and cleaner energy production for the future. The divine link between these co-benefits: a stronger local and global community.

For organizations that purchase the credits, there are more benefits. They get to foster goodwill with consumers, positively contribute to their ESG goals, and strengthen relationships with companies that expect more sustainable suppliers.

At Radicle, we can help you navigate the complexities of purchasing credits.

If you have questions about the creation, commerce, and use of carbon credits, we’re here to provide answers. Reach out and let us know how. We’re here to bring you into the world of carbon trading.

What to Consider When Buying Voluntary Carbon Credits

Now is the time for companies to set climate targets. While many organizations are working to reduce their emissions, some may not be able to make all the reductions they want cost-effectively. Luckily, there are other means available to reduce carbon emissions. Carbon credits, also known as carbon offsets, help businesses reduce emissions and positively impact the world.

Selecting the right voluntary credits for your organization to purchase may seem complex and daunting, but that’s why we’re here. Below are the factors to consider when buying voluntary carbon credits.

Carbon Credits as Part of an ESG Strategy

The starting point for any carbon credit purchase is planning a companywide ESG strategy (Environmental, Social, and Governance). The “environmental” component is critical to identifying your emission targets and the broader positive impact you plan to have on the world. Once you know the goal, you can plan how to optimally pair emission reductions from your operations with credit purchases to achieve it.

What Kind of Projects Provide Carbon Credits?

Every credit purchased represents one tonne of CO2 equivalent prevented from entering the atmosphere or removed altogether. These credits are created from projects around the world.

The main project categories are:

- Renewable Energy Generation: the use of energy technology (solar, wind, or geothermal power) to decrease fossil fuel emissions

- Nature-Based Solutions: ecological initiatives like tree planting or conservation efforts that absorb carbon from the atmosphere

- Waste Management: the recycling and reuse of materials for future needs or additional energy generation

- Industrial Processes: installing better, more efficient technologies to curb CO2e emissions directly

Depending on your organization’s needs and goals, you should choose the project(s) that most aligns with your values and brand story.

Benefits When Buying Carbon Credits

Emissions reduction is the primary function of a credit purchase, but there are other secondary benefits as well. The secondary benefits of the process create positive effects that often loop back to your ESG strategy. By purchasing carbon credits, you can often help struggling or growing communities:

- Reduce poverty and hunger

- Access affordable and clean energy

- Achieve better education, gender equality, and overall health

- Capitalize on economic opportunities

- Preserve biodiversity in their area

- Plan for a more sustainable future

These investments can become self-sustaining positive feedback loops, where economic prosperity and climate responsibility work hand-in-hand.

Scope, Vintage, and Standard of Carbon Credits

Once you have narrowed down your desired project area and secondary benefits, the next considerations are:

Project scale

The scale (or scope) of projects, and therefore credits, can vary from small communities to entire regions or nations. You should choose a project that delivers for your ESG strategy.

Age of credits

Credits represent a verified reduction that happened in the past at a specific time, so each credit is tied to an impact in the past. Projects issue credits at different intervals, often yearly, leading to credits of differing vintages being available on the market. It is like wine, coins, or whiskey, except older credits are often more cost-effective than an equivalent credit tied to a more recent reduction.

Certification standard

Various standards around the globe verify projects to provide structure, guidance, specifications, and monitoring to ensure integrity. There are different standards and certifications, such as Verified Carbon Standard (VCS/Verra) or American Carbon Registry (ACR). It is essential only to purchase credits verified by a credible standard.

The Price of Carbon Credits

While all credits represent one tonne of CO2e, not all are priced equally. A variety of factors determines their final value: the type and total development costs of the project they originate from, their standard and vintage, as well as their originating location and co-benefits. In the end, it all comes down to supply and demand, because credits are not pure commodity products. They are unique, and a host of interconnected influences determines their value.

When selecting a counterparty for trading in carbon markets, our experience and capacity to meet financial and contractual obligations put us a cut above for a successful carbon credit purchase. We even blend “baskets” of offsets to meet our clients’ budgetary, ESG, and brand-alignment needs to deliver the best possible pricing on coveted credits. Our experience with global carbon markets and transactions will net more than great value – we also protect your legal and commercial interests and mitigate risk in the process.

Our team can ensure you participate in carbon markets with confidence and that your investment delivers on your ESG strategy.

To find out more about carbon credit buying and how Radicle can help you achieve your ESG goals and enhance business operations, reach out.

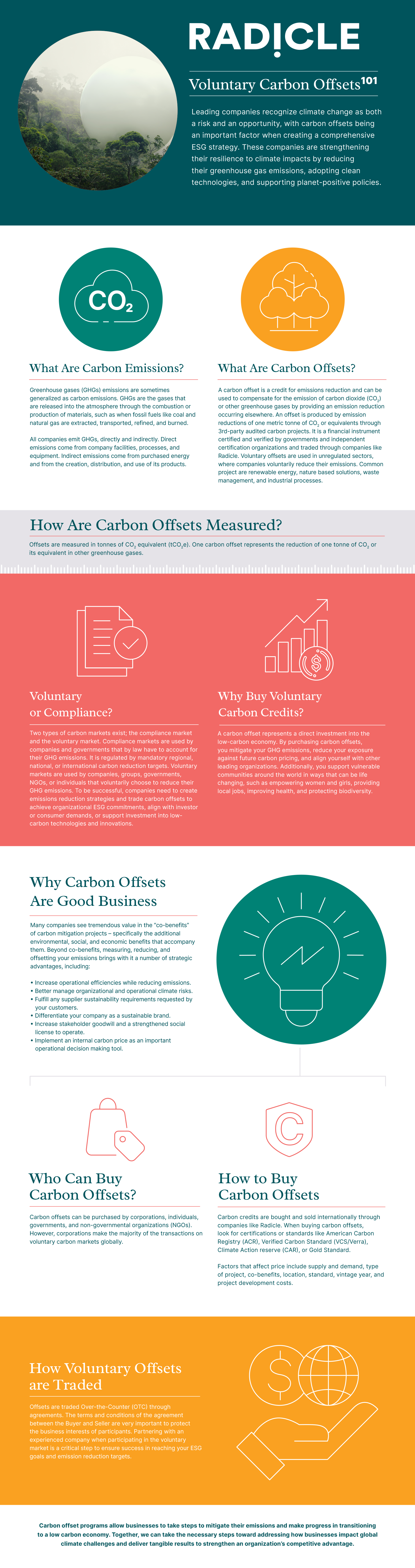

The Basics of Carbon Offsets

Forging a path to carbon neutrality or net-zero has many benefits for organizations: it strengthens their social license to operate, increases operational efficiencies, opens new revenue streams, and supports their brand story with compelling, purposeful, and impactful content. It also helps mitigate risk and provides more transparency and accountability across supply chains, along with other benefits.

Purchasing carbon offsets, also known as carbon credits, can help business leaders on their path to carbon neutrality and net-zero while maintaining and even enhancing their competitiveness. And they enable leaders to affect positive change locally and abroad. Carbon offsets are a crucial tool in emissions reduction strategies for organizations adapting to the low-carbon economy.

Credits also provide incentives and funding that stimulate better reduction technologies, and they encourage policies fostering transitions to a low-carbon economy.

They’re just good business.

What are carbon emissions?

Greenhouse gases (GHGs) are released into the atmosphere through the combustion or production of materials. Emissions are harmful to the environment and are the leading cause of human-induced climate change. Since virtually every facet of modern society requires energy, all companies emit some GHGs. These can be direct – like on-site power generation via diesel or gasoline – or indirect, by way of purchased power, supply chains, and so on.

What are carbon offsets?

Carbon offsets are an environmental commodity that mitigates GHGs. Companies purchase these credits from verified, third-party projects that prevented or removed emissions in the past. For these projects to generate carbon offsets, they must prove the reduction would not have taken place without them. These projects range from renewable energy conversions and equipment improvements to forestry conservation and landfill methane management. Each credit represents a reduction of one tonne of CO2 or its equivalents, which a buyer can apply against its own emissions. While carbon offsets are an important transitional step to a low-carbon economy, industry-wide emissions reductions remain vital.

While a single tonne of lightweight gases may seem significant, the annual worldwide emission total is currently about 40 billion tonnes, with an upward trend starting from the late ‘80s. Carbon offset markets are a tool that enables companies to send that 80’s trend the way of slap bracelets and jelly shoes: down and out forever.

Carbon Offset Markets

There are two categories of carbon markets for purchasing credits: compliance markets and voluntary markets. Entities that must account for their GHG emissions due to specific regulations and legally mandated targets use compliance markets to remain compliant. Voluntary markets are used by organizations that take action voluntarily as part of their ESG practices. They are not required to by any regulation or legislation.

Organizations that go beyond compliance help lead environmental sustainability efforts, enhance their business operations, and deepen their competitive advantage. More and more stakeholders are expecting organizations to take action, including investors, employees, and customers.

In the voluntary market, companies may choose to buy these credits for several reasons:

- Accelerate emission reduction strategies

- Align with client and stakeholder expectations

- Mitigate GHG emissions and account for long-term environmental considerations

- Reduce exposure to future carbon pricing (the offset will already be in place, even if the price increases)

- Strengthen organizational values and culture

- Support the development of low-carbon or emission reduction technologies or innovations

Some credit purchases also provide jobs, protect biodiversity, and give support to vulnerable communities. These are referred to as “co-benefits.” Co-benefits are broadly advantageous. Purchasing carbon credits is an excellent way to set your organization apart from the rest.

Buying Carbon Credits

There are few limitations on who can purchase carbon offsets. Buyers may be individuals, companies, governments, or NGOs, though companies are responsible for most transactions.

It’s essential to purchase credits confirmed by a reputable intermediary for risk mitigation and assurance that business objectives can be achieved. There are different standards and certifications, such as Verified Carbon Standard (VCS/Verra) or American Carbon Registry (ACR). The price fluctuates depending on specific circumstances and projects. These factors can include locations, project types, project age, and demand.

Because of the complexity of these markets and the various standards and certifications, many credits are bought and sold internationally by brokers and developers like Radicle. This provides companies risk protection and ensures their purchases fit their ESG strategy and have the most impact.

Businesses are leading the charge to balance people, the planet, and profit. We’re helping them evolve and showing them how the transition to a low-carbon economy can be a competitive advantage.

If you are new to the carbon trading market and looking to defy your business’ limits, we are here to help guide you through the entire process. Reach out and get in touch and together we will create a bespoke and impactful emissions reduction strategy to deliver tangible results in a low-carbon economy.

Calgary, Canada – Radicle Group Inc. (Radicle) is pleased to announce today that Alastair Handley, Radicle’s Founder, has been named to Canada’s 2021 Clean50 for advancing sustainability and clean capitalism in Canada.

Canada’s Clean50 Awards are announced annually by Delta Management Group and the Clean50 organization to recognize those 50 individuals or small teams, from 16 different categories, who have done the most to advance the cause of sustainability and clean capitalism in Canada over the past 2 years.

”Delta’s criteria in determining Honourees is to carefully consider actual measurable accomplishments, demonstrated innovation, collaboration with other organizations, and the power of the Honouree’s contribution to inspire other Canadians to take similar action,” says Gavin Pitchford, CEO, Delta Management Group. “Alastair Handley was chosen after rigourous screening and research by Delta Management, with advice from internal researchers and external advisors, and was among Honourees selected from an initial pool of approximately 900 well qualified nominees.”

“I’m incredibly honoured to be recognized as one of Canada’s 2021 Clean50 Honourees and recognize that it is a reflection of the incredible people that have chosen to work at Radicle,” says Alastair Handley. “I’m also thrilled to know that there were over 900 well qualified nominees this year, which is a reflection of the important hard work happening in our country to advance sustainability and the transition to a low-carbon economy.”

Alastair is advancing the impact of the carbon trading market in Alberta through Radicle’s proprietary software, a platform that measures, reports, and verifies greenhouse gas (GHG) emission reductions for their customers and develops Methane Reduction Retrofit Compliance Plans to facilitate the shift to more sustainable oil and gas production. Over the last two years, Radicle has quantified 1.1 million tonnes of GHG emissions in the agriculture sector from farmers that converted to sustainable agriculture practices and 872,054 tonnes in the energy sector by facilitating the switch to zero or low methane emission oil and gas production equipment. Radicle has produced 10% of all carbon credits generated in Alberta, representing 6.85 million tonnes of emissions reduced, and delivered over $100 million to clients. Looking forward, Alastair is focusing efforts on helping the 1.2 million small and medium-sized businesses in Canada create their pathways toward achieving net-zero.

The incoming Clean50 Honourees, including Alastair Handley, will be recognized on September 30, 2021, at the Annual Clean50 Summit.

About Delta Management Group and Canada’s Clean50

Leading ESG, sustainability and clean tech search firm Delta Management Group in 2011 founded, and remains the steward of the Canada’s Clean50 awards, created to annually identify, recognize and connect 50 sustainability leaders from every sector of Canadian endeavor, in order to facilitate understanding, collaboration and innovation in the fight to keep climate change impacts below 1.5 degrees C. Ancillary awards also recognize 20 Emerging Leaders and the Top Sustainability Projects of the year, as well as bestow Lifetime Achievement designations. Visit https://www.clean50.com to learn more.

About Radicle

Radicle helps guide today’s progressive companies towards tomorrow’s sustainable future. From our early beginnings in Calgary, Canada, when we developed one of the world’s first software platforms to measure, qualify, and aggregate greenhouse gas emissions, we’ve now taken root internationally to leverage data, insights, and technology to safeguard our shared tomorrow. Radicle works with agriculture, energy, forestry, manufacturing, commercial, and financial services to enable planet-positive solutions by increasing efficiency while lowering costs and emissions. We believe that financial and environmental sustainability are two sides of the same coin: balance between the two is possible. Visit radiclebalance.com to learn more.

Calgary, Canada – Radicle Group Inc. (Radicle) President, Saj Shapiro, announced today that Radicle is investing in Canary Biofuels Inc., a new generation biofuels production company in Southern Alberta, Canada.

“By using agriculture waste products, Canary will produce biodiesel that provides new revenue sources for local Western Canadian agricultural producers. A key benefit of producing biodiesel is that it is in high demand and will significantly reduce carbon emissions at scale,” commented Shapiro. “The Canary Biofuels facility is scheduled to run at full capacity by year-end.”

“We are excited to showcase how Western Canadian expertise in both the agriculture and energy sectors can help reduce carbon emissions for both Alberta and North America. We will use our local expertise to produce biofuel products that reduce waste and cut carbon emissions,” stated George Wadsworth, President and CEO of Canary.

Radicle is applying its expertise in carbon markets and Low Carbon Fuel Standard (LCFS) regulations to identify opportunities and help project developers maximize greenhouse gas (GHG) emission reductions and minimize compliance costs.

“Our goal is to align our interests with those of our partners to make better strategic decisions that enhance environmental performance, reduce regulatory risks, and optimize long-term value steams,” said Shapiro.

To learn more about how Radicle is accelerating low-carbon fuels, reach out to Brad Neff, Director of Biofuels, at bneff@radiclebalance.com.

About Radicle

Radicle helps guide today’s progressive companies towards tomorrow’s sustainable future. From our early beginnings in Calgary, Canada, when we developed one of the world’s first software platforms to measure, qualify, and aggregate greenhouse gas emissions, we’ve now taken root internationally to leverage data, insights, and technology to safeguard our shared tomorrow. Radicle works with agriculture, energy, forestry, manufacturing, commercial, and financial services to enable planet-positive solutions by increasing efficiency while lowering costs and emissions. We believe that financial and environmental sustainability are two sides of the same coin: balance between the two is possible. Visit radiclebalance.com to learn more.

Radicle helps companies enable planet-positive solutions. We’ve developed one of the world’s first software platforms to measure, qualify, and aggregate greenhouse gas emissions. Our team has also consulted with our clients and industry partners globally about monetizing their environmental, social, and corporate governance (ESG) efforts. While our achievements are something we’re sure proud of, we’re hyper-focused on the future and new ways of doing things. Our latest inspiration is the Circular Economy.

The expert Sustainability Communications team members at Radicle hold a specialized certification in the Circular Economy (Design for Sustainability) from the

Technische Universiteit Delft in the Netherlands. So, we sat down with members of Radicle’s own Sustainability Communications Unit – Claudia Aguirre, Head of Strategy, and Jennifer Dooley, Senior Strategist, to get down to the basics of what the Circular Economy is all about.

Q. Can you explain to us what the Circular Economy is?

“I learned about the Circular Economy while doing my early training with the Ellen MacArthur Foundation, based in the United Kingdom. They explain that the Circular Economy is different from the ‘take-make-waste’ extractive industrial model and instead designs waste out of the system, building on economic, natural, and social capital. Basically, it involves decoupling economic activity from the consumption of finite resources,“ explains Claudia.

Jennifer adds: “It sounds complicated, but the Circular Economy is really based on three simple principles: designing out waste and pollution, keeping products and materials in use, and regenerating natural systems.”

Q. Can you take us through the first principle – designing out waste and pollution?

“The first principle, designing out waste and pollution, asks businesses to rethink the supply chain and challenges them to avoid waste and pollution. If you can do this in early product development, that is the best case scenario”, mentions Claudia. She goes on to say, “much of the waste that releases greenhouse gases into the environment comes from structural waste – polluting air, land, and water.”

“Take the example of Tru Earth laundry detergent, a company that is currently enrolled in our very own Climate Smart Certification program”, describes Jennifer. “Tru Earth has designed waste out of the process of doing laundry entirely. They use zero waste laundry detergent strips, packaged in a compostable cardboard sleeve. Each laundry strip dissolves completely when placed in the wash. The ingredients themselves are hypoallergenic and eco-friendly!”

Q. What about the second principle? What does keeping products and materials in use involve?

“The second principle is all about reimagining an economy that doesn’t use up finite resources but instead reuses, remanufactures, or recycles,” continues Jennifer.

Claudia adds: “The end goal is to use bio-based products, components, and materials to positively impact the economy and the environment. Take the case of Rocky Mountain Soap company. Their liquid soaps, conditioner, and shampoos are offered in 1 litre refill formats – customers return them to the store where they are taken back to their workshop, sanitized, and then reused! And, that is not their only innovation – their latest beauty product – a line of tinted lip colours, is sold in biodegradable packing”.

Q. Explain to us the last principle, regenerating natural systems. How can businesses do this?

“Think about it like this – can we as businesses not only protect but improve our environment? What if we could not just preserve renewable resources but return resources to the soil to support regeneration!” explains Jennifer.

Claudia adds: “Take conservation cropping as an example. Radicle’s agriculture services reward farmers who use no or low-till farming to trap carbon dioxide in the ground, helping mitigate agriculture’s impact on climate change.”

Q. How can I learn more?

“At Radicle, we’re eager to assist your organization in telling your circularity story to the world. Reach out to us, and our Sustainability Communications team will bring to life your Circular Economy integration plans and social change strategies!” says Claudia.

Connect with us.

Calgary, Canada – Radicle Group Inc. (Radicle) Chairman and CEO, Ed Alfke, announced today that Radicle’s Founder, Alastair Handley, will be shifting focus to dedicate more of his time to becoming Radicle’s chief evangelist alongside his sustainability sector development priorities. These include building out the Radicle Foundation, deepening awareness on the role emissions offsets have in corporations’ sustainability strategies, advising government and NGOs, in addition to his increasing engagement in the global forum on tackling climate change. As Founder, he will continue to serve as a Director and strategic advisor to leaders in the company.

Saj Shapiro steps into the role of President, expanding his responsibilities beyond those as Chief Operating Officer to complete an executive team adjustment.

“Saj’s open style and deep leadership skills allow him to integrate our team’s burgeoning culture with global operations excellence to deliver a winning business strategy that enables profitable corporate sustainability for our clients,” commented Alfke when announcing the change.

“It’s a tremendous, somewhat daunting journey we’re on as we wrestle prosperity and the climate change challenge. Yet balance is possible. This requires an ecosystem of varied solutions, and Radicle plays its part. The team’s work continues to expand in helping solve society’s most pressing challenge,” states Handley. He adds, “As carbon markets expand globally, creative financing will release capital to enable more widespread deployment of emission reducing technologies. I seek to empower corporations to leverage such hybrid strategies, blending rigorous data processing, sustainable finance, and leveraging emissions markets. The space where sustainability and margins meet fascinates me.”

Radicle’s Board of Directors continues to benefit from Alastair’s industry knowledge and Saj’s leadership, CFO Dwayne LaMontagne’s financial acumen and CEO Ed Alfke’s vision. Radicle will continue to benefit from all their ongoing vigour and advice to accelerate emissions reductions at scale.

About Radicle

Radicle helps guide today’s progressive companies towards tomorrow’s sustainable future. From our early beginnings in Calgary, Canada, when we developed one of the world’s first software platforms to measure, qualify, and aggregate greenhouse gas emissions, we’ve now taken root internationally to leverage data, insights, and technology to safeguard our shared tomorrow. Radicle works with agriculture, energy, manufacturing, commercial, and financial services to enable planet-positive solutions by increasing efficiency while lowering costs and emissions. We believe that financial and environmental sustainability are two sides of the same coin: balance between the two is possible. Visit radiclebalance.com to learn more.

Today, Radicle Group Inc. (Radicle) and Well Done Foundation Inc. (WDF) signed an agreement that helps finance and complete the plugging of 30 orphaned oil wells in Northern Montana, while creating a template to expand the WDF model to a much larger scale, according to WDF founder and Chairman Curtis Shuck.

Radicle will underpin the plugging of the wells and the restoration of land surrounding them in advance through the sale of carbon offsets; the scale of the project will provide a template to expand WDF’s mission throughout North America. As part of the agreement, Radicle will have the exclusive rights to market and sell carbon credits that fund the WDF’s projects.

“This strategic partnership will provide the Well Done Foundation with the game-changing resources to scale up more quickly,” Shuck said. “We are currently expanding our operations to Kansas, Texas, Colorado, California, Pennsylvania, New York and West Virginia. What may have been seen as a drop in the bucket initially is proving to be making a real difference, one well at a time, because every little bit counts in the bigger picture and actions deliver results.”

Both organizations recognize the significant environmental benefits of completing this work: there are currently 3.2 million nonproducing oil and gas wells in the US alone, all open and emitting thousands of metric tonnes of carbon and methane each year. To put it in perspective, each open well can emit as much carbon annually as 1,500 cars.

“At Radicle, we are motivated to leave the planet better than we found it, and this is why we partnered with Well Done Foundation,” Radicle President Alastair Handley said. “This partnership is solving a critical environmental threat at scale in an entrepreneurial way. By leveraging the value of carbon credits, we support the Well Done Foundation to succeed in its cause. This financing of ‘plugging plans’ and orphan well adoption is a key innovative step in our journey together.”

The “Well Done Process” is a multi-step initiative built upon public and private partnerships: the Well Done Foundation identifies a high-emitting orphaned and abandoned oil or gas well and qualifies it through a rigorous measurement and monitoring regiment, bonds it with the regulatory body, and then launches a campaign to raise funds to plug the well and restore the impacted surface areas. Working closely with the surface landowners, WDF develops a “plugging plan” and obtains a permit from the state for the project.

Next, it identifies and designates an “adoptive family” for the orphaned and abandoned well (either a corporate or individual benefactor), selects a team for the downhole and surface work, and executes the project to successful completion.

Radicle specializes in supporting organizations like WDF, and over 3,000 others, to monetize their environmental efforts. In this project, Radicle has been supporting WDF in the development of a carbon offset methodology through the American Carbon Registry (ACR)’s program to create a pathway to monetization for the reduction in emissions.

To purchase carbon offsets through the WDF/Radicle partnership, visit: https://welldonefoundation.com/purchase-carbon-offsets/. To discover more about leveraging Radicle’s sustainable finance for eligible projects, email info@radiclebalance.com and visit radiclebalance.com.

About the Well Done Foundation

Formed in 2019, the Well Done Foundation enables the oil and gas industry to partner with the conservation community to create an alternative pathway to success that benefits all. The Well Done Process creates a strategic partnership among regulators, surface owners and adoptive parties, leading to a safe and seamless system that provides cost-effective and lasting results that improve the environment while working with the industry in a transparent structure that delivers value to its triple bottom line: community partnerships (people), environmental responsibility (planet), and economic benefits (vitality). Montana’s Golden Triangle Region is home to some of the richest soil and most productive growing acres in the United States. WDF works with its partners to transition the orphaned well sites into their next levels of service. For more information, visit https://welldonefoundation.com/.

About Radicle

Radicle helps guide today’s progressive companies towards tomorrow’s sustainable future. From our early beginnings in Calgary, Canada, when we developed one of the world’s first software platforms to measure, qualify, and aggregate greenhouse gas emissions, we’ve now taken root internationally to leverage data, insights, and technology to safeguard our shared tomorrow. Radicle works with agriculture, energy, manufacturing, commercial, and financial services to enable planet-positive solutions by increasing efficiency while lowering costs and emissions. We believe that financial and environmental sustainability are two sides of the same coin: balance between the two is possible. Visit radiclebalance.com to learn more.

We thought we’d kick off 2021 by sharing advancements in our space. Today, Radicle looks at ten sustainability innovations from around the globe. From raving over personal care items made with captured carbon to gushing over robotic dogs that can sniff out methane, we’ve curated a pretty fascinating list.

1. Environmentally friendly soap made with captured carbon

CleanO2 is a Calgary-based soap company changing the way consumers think about environmentally friendly soap products. They are founded by inventors that saw a problem with carbon emissions and decided to roll up their sleeves to make a product that truly makes a difference.

Formulated using the company’s very own trade-marked carbon capture units (aka “CARBiN-X™”), CleanO2 brings a new meaning to “made-in-house.” These carbon capture units convert CO2 captured from heating system exhaust into the carbonate used in their soaps.

In addition to providing the market with some great soap, our environment also benefits from its purchase. Now that’s a brand that epitomizes sustainability!

2. Electric boating

X Shore combines new technologies with boating craftsmanship to deliver 100% electric boats.

Born on the Swedish coast, X Shore is being coined as the Tesla of the boating industry. The company does an excellent job of describing the electric boating experience: “explore the oceans, lakes, and nature without the harmful noise and fumes a fossil-fuel engine emits. Knowing that you are connecting to and blending in with your surroundings while travelling in time, without harming the environment, instills a great sense of liberty and harmony”.

Wouldn’t you want to take a ride in one of these? We certainly would!

3. Electric-powered de-icer trucks

Have you heard of the Danish company, Vestergaard, which manufactures, distributes, and supports state-of-the-art equipment for the aviation industry? They recently collaborated with Montreal-based de-icing company Aéro Mag to bring a new product to the market.

Electric de-icer trucks. Yup, you heard that right. This hyper-focused partnership has resulted in the world’s first electric-powered de-icing truck!

In addition to leading in innovation, the truck produces 87% less greenhouse gas (GHG) emissions, contributing to Aéro Mag’s strategic objective of becoming a carbon-neutral company by 2035.

4. Robotic dogs

Now, robotic animals can automate processes, enhance sustainability, and increase safety. Boston Dynamics and their premier robotic dog, Spot, is available to construction, oil and gas, utilities, and public safety industries.

As explained in this Reuters article, not only can Spot “read gauges, look for corrosion, [and] map out the facility” of an oil rig (as is the case with one operated by British Petroleum), but Spot can “even sniff out methane”!

A proof point that the technologies we use to identify and reduce methane emissions are becoming man’s best friend!

5. Robots to automate farming

Alberta’s post-secondary institution Olds College has its very own living agriculture lab. The “Smart Farm” bridges the gap between technology and the sustainability of agriculture-food production. Olds College is also the only post-secondary institution in the world to deploy fully autonomous equipment on the Smart Farm to measure agriculture’s economic and environmental footprint. A number of Canadian funders and partners are behind the DOT Autonomous Platform at Olds College, including Saskatchewan-based autonomous agriculture start-up Dot Intelligence Inc.

We call this one the intersection of farming practices and technology, and it signifies real transformation for agriculture.

6. Solar-powered autonomous boats

What do you get when you put together solar power, autonomous boats, and real-time information? The perfect solution for protecting our oceans.

Whether it’s identifying at-risk whale species, cracking down on illegal fishing, or data monitoring to better understand climate change (and its impact), Open Ocean Robotics covers it all.

How’s that for a cleantech solution to collecting ocean data?

7. Technology for reducing GHGs in the oil and gas sector

Researchers from the Portable Methane Leak Observatory (PoMELO) at the University of Calgary brought actionable mobile technology solutions to the Stanford University Mobile Monitoring Challenge through their efforts to detect leaks of a potent GHG from oil and gas facilities.

Take a read about the achievement here, part of Stanford’s Natural Gas Initiative and the U.S.-based Environmental Defense Fund (EDF). We bet you’ll find it as interesting as we do.

8. Making ethanol from consumer packaged waste

Louisville Parallel Products creates ethanol from discarded consumer goods, paving the way to renewable energy and biofuel innovation within the recycling community.

Their environmentally sound model and solutions give real alternatives to hazardous waste disposal for beverage, chemical, health and beauty, as well as pharmaceutical industries. Each year, Parallel Products produces over 6.5 million gallons of waste-derived ethanol from the fermentation of sugar-laden liquids and the distillation of alcohol-based products.

Now that’s impact if we have ever seen it!

9. Reduce the amount of carbon dioxide (CO2) in the atmosphere using carbon engineering

1PointFive focuses on climate stabilization through the rapid deployment of carbon engineering.

How? By developing the largest Direct Air Capture facility in the world. The facility alone is projected to capture one million tons of CO2 each year.

We can’t wait to watch this one unfold. It’s expected to be in full operation within a few years.

10. Carbon markets offset trading

It wouldn’t be a Radicle blog about cleantech without a small plug for ourselves, right? As part of our Radicle Financial Services, we offer companies and people the ability to invest in innovative and sustainable practices through carbon markets.

Each offset (or carbon credit) generated through reducing or avoiding GHG emissions is assigned a financial value through an exchange between buyers and sellers.

We think it’s pretty neat.

To re-cap

Each innovation mentioned above proves sustainability is becoming the foundation for technological advancement. Do you know of a technological advancement that benefits our planet’s future while creating prosperity for generations to come? Reach out to us. We’d love to hear about it.