Carbon Offsets 101 – Leveraging the Power of Emissions Markets

June 10, 2021

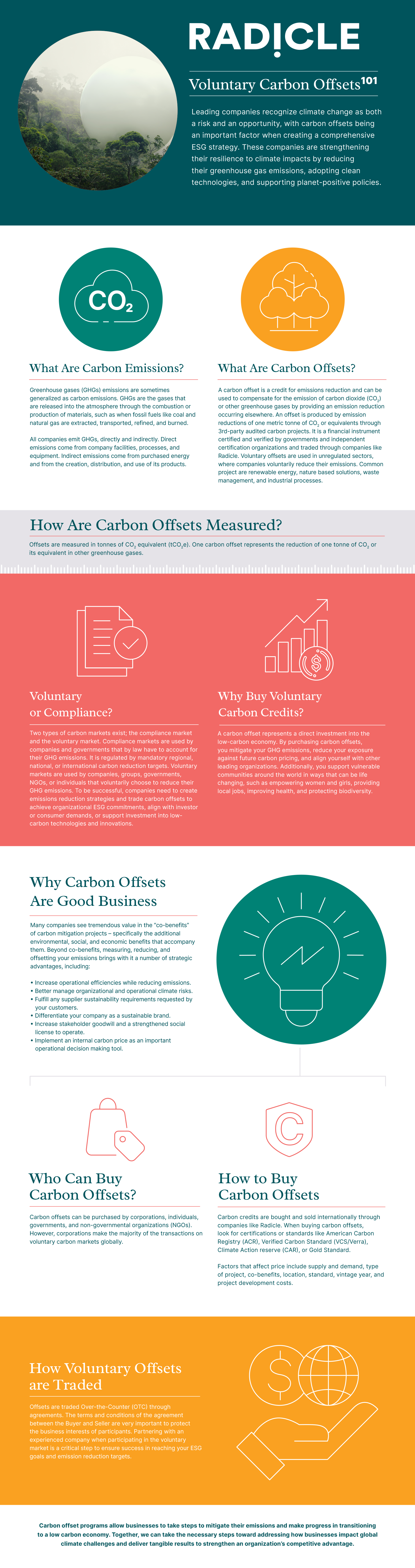

The Basics of Carbon Offsets

Forging a path to carbon neutrality or net-zero has many benefits for organizations: it strengthens their social license to operate, increases operational efficiencies, opens new revenue streams, and supports their brand story with compelling, purposeful, and impactful content. It also helps mitigate risk and provides more transparency and accountability across supply chains, along with other benefits.

Purchasing carbon offsets, also known as carbon credits, can help business leaders on their path to carbon neutrality and net-zero while maintaining and even enhancing their competitiveness. And they enable leaders to affect positive change locally and abroad. Carbon offsets are a crucial tool in emissions reduction strategies for organizations adapting to the low-carbon economy.

Credits also provide incentives and funding that stimulate better reduction technologies, and they encourage policies fostering transitions to a low-carbon economy.

They’re just good business.

What are carbon emissions?

Greenhouse gases (GHGs) are released into the atmosphere through the combustion or production of materials. Emissions are harmful to the environment and are the leading cause of human-induced climate change. Since virtually every facet of modern society requires energy, all companies emit some GHGs. These can be direct – like on-site power generation via diesel or gasoline – or indirect, by way of purchased power, supply chains, and so on.

What are carbon offsets?

Carbon offsets are an environmental commodity that mitigates GHGs. Companies purchase these credits from verified, third-party projects that prevented or removed emissions in the past. For these projects to generate carbon offsets, they must prove the reduction would not have taken place without them. These projects range from renewable energy conversions and equipment improvements to forestry conservation and landfill methane management. Each credit represents a reduction of one tonne of CO2 or its equivalents, which a buyer can apply against its own emissions. While carbon offsets are an important transitional step to a low-carbon economy, industry-wide emissions reductions remain vital.

While a single tonne of lightweight gases may seem significant, the annual worldwide emission total is currently about 40 billion tonnes, with an upward trend starting from the late ‘80s. Carbon offset markets are a tool that enables companies to send that 80’s trend the way of slap bracelets and jelly shoes: down and out forever.

Carbon Offset Markets

There are two categories of carbon markets for purchasing credits: compliance markets and voluntary markets. Entities that must account for their GHG emissions due to specific regulations and legally mandated targets use compliance markets to remain compliant. Voluntary markets are used by organizations that take action voluntarily as part of their ESG practices. They are not required to by any regulation or legislation.

Organizations that go beyond compliance help lead environmental sustainability efforts, enhance their business operations, and deepen their competitive advantage. More and more stakeholders are expecting organizations to take action, including investors, employees, and customers.

In the voluntary market, companies may choose to buy these credits for several reasons:

- Accelerate emission reduction strategies

- Align with client and stakeholder expectations

- Mitigate GHG emissions and account for long-term environmental considerations

- Reduce exposure to future carbon pricing (the offset will already be in place, even if the price increases)

- Strengthen organizational values and culture

- Support the development of low-carbon or emission reduction technologies or innovations

Some credit purchases also provide jobs, protect biodiversity, and give support to vulnerable communities. These are referred to as “co-benefits.” Co-benefits are broadly advantageous. Purchasing carbon credits is an excellent way to set your organization apart from the rest.

Buying Carbon Credits

There are few limitations on who can purchase carbon offsets. Buyers may be individuals, companies, governments, or NGOs, though companies are responsible for most transactions.

It’s essential to purchase credits confirmed by a reputable intermediary for risk mitigation and assurance that business objectives can be achieved. There are different standards and certifications, such as Verified Carbon Standard (VCS/Verra) or American Carbon Registry (ACR). The price fluctuates depending on specific circumstances and projects. These factors can include locations, project types, project age, and demand.

Because of the complexity of these markets and the various standards and certifications, many credits are bought and sold internationally by brokers and developers like Radicle. This provides companies risk protection and ensures their purchases fit their ESG strategy and have the most impact.

Businesses are leading the charge to balance people, the planet, and profit. We’re helping them evolve and showing them how the transition to a low-carbon economy can be a competitive advantage.

If you are new to the carbon trading market and looking to defy your business’ limits, we are here to help guide you through the entire process. Reach out and get in touch and together we will create a bespoke and impactful emissions reduction strategy to deliver tangible results in a low-carbon economy.